Summary

The Bitcoin Lightning Network has been designed as a global payment network. However, unlike traditional payment networks, Lightning not only involves messaging, i.e., the exchange of payment instructions but also immediately involves a final bilateral settlement. Thus, each successful payment over the Lightning Network is immediately final and cannot be reversed. As described in previous articles, Lightning’s technical characteristics make it ideal for micro- and nano-payments. Combined with instant final settlement on a global scale, the Lightning Network offers compelling use cases around payment processing for many industries. This article highlights several key industry use cases of Lightning. These include machine-to-machine (M2M) payments, power grid optimization, and advancing automation through smart contracts.

The Importance of Lightning for the Industry

While Lightning development is still in its infancy, more and more companies are getting on board with the network. MicroStrategy, known for its Executive Chairman Michael Saylor and holds over 100,000 Bitcoin, announced in summer 2022 that it plans to make Lightning software available for industrial applications and has set up an internal Lightning Research Lab for this purpose. This year, David Marcus, former Board Member of Diem (Libra) Association and Head of Facebook’s Novi, launched Lightspark, a company exploring the utility of Bitcoin for payments with a strong focus on Lightning to develop software for enterprise applications.

The interoperability of Lightning’s various use cases is groundbreaking. As an open and distributed payment standard, different platforms and applications can be built that are compatible with each other at the payment level. For example, think of a crowdfunding campaign on Kickstarter. Imagine payment processing going beyond Kickstarter’s website onto a social media post, a private message, or even posters and flyers, without the backer ever having to visit the website. In the same way, consumer applications are interoperable with industry applications via the Lightning Network and can be seamlessly integrated.

Industrial Use Cases

One of the most exciting features of Lightning is the viability of nano-payments, i.e., payments that can be arbitrarily small, e.g. in the sub-cent range. This possibility of nano-payments enables companies to not only create new business models, but also optimize existing business models.

In many industries, high costs arise due to downstream payment processing and financial intermediaries. Companies sometimes must make payments months or even quarters in advance before the goods or services are delivered. Thanks to the feasibility of nano-payments over the Lightning Network, deliveries and payment flows can theoretically take place simultaneously, and, as a result, financial inefficiencies can be massively reduced. Selected industry use cases are detailed below.

Machine-to-Machine Payments

In addition to payments manually triggered by humans, machines can also trigger a payment with final settlement due to the programmability of payments via Lightning. These payments can also be sent directly to other machines. Today, when we talk about M2M payments, we should be talking about M2M accounting. Machines do not usually have their own “payment accounts”; these are usually run through the machines’ owners. However, the machine can be granted authorization for certain payments. Thanks to the economics of nano-payments via Lightning, machines can theoretically send or receive a payment for every action.

For example, without registration, KYC processes, and human interaction, one could:

Today, such a process is not easy to perform, but it will become more relevant with future applications such as self-driving cars or robotics. A self-driving car should ideally work as an autonomous cab, which can ideally be used and paid for by the minute. In addition, payment flows can be split and forwarded via Lightning in a fully automated way. For example, the owner of an e-car charging station can forward the incoming payments per kilowatt hour directly to the landlord of the property, the electricity supplier, or the maintenance company and only retain their own margin.

Power Grid Optimization

Today, the energy market is particularly plagued by financial inefficiencies. For example, payments for electricity consumption currently flow much more slowly than the electricity itself. Electricity producers, traders, and grid operators prepay for months until they receive payment for the electricity from the consumer in bundled form. Although electricity prices can vary widely over time and space, companies in the energy industry need to make a blended calculation for the price and hedge against the associated volatility risk. Currently, it is only possible in a few cases to pass on short-term price fluctuations to the consumer.

In the U.S., about 10% of the price of energy can be attributed to the problem of financial inefficiency. These additional costs arise from intermediaries in payment processing, increased administrative overhead in billing, and risk management, among other things. These costs can be significantly reduced if energy and money can flow at the same speed and payments can be automatically routed to all participants in the value chain instantaneously. M2M payments also come into play here, as most households already have a smart meter, which could also make automated payments per unit of electricity.

Hyper Automation and Smart Contracts

Thanks to the ease with which Lightning payments can be programmed, companies can extend their process automation to payment flows as well, not only reducing the burden on accounting staff through automation, but also reducing the chance of errors. For example, if an ERP system were directly connected to the Lightning Network, almost completely automated payments could be sent to all service providers, suppliers and partners, and incoming payments from customers could be posted directly in the system. A nice side effect: there is a complete documentation of all incoming and outgoing payments directly in the company’s own cloud/IT environment, without the company still needing an intermediary for payment processing. This is possible because Bitcoin and the Lightning Network makes the vertical integration of financial services possible for the first time. Companies can be their own bank and thus become more independent and efficient.

Cross-Border Payments

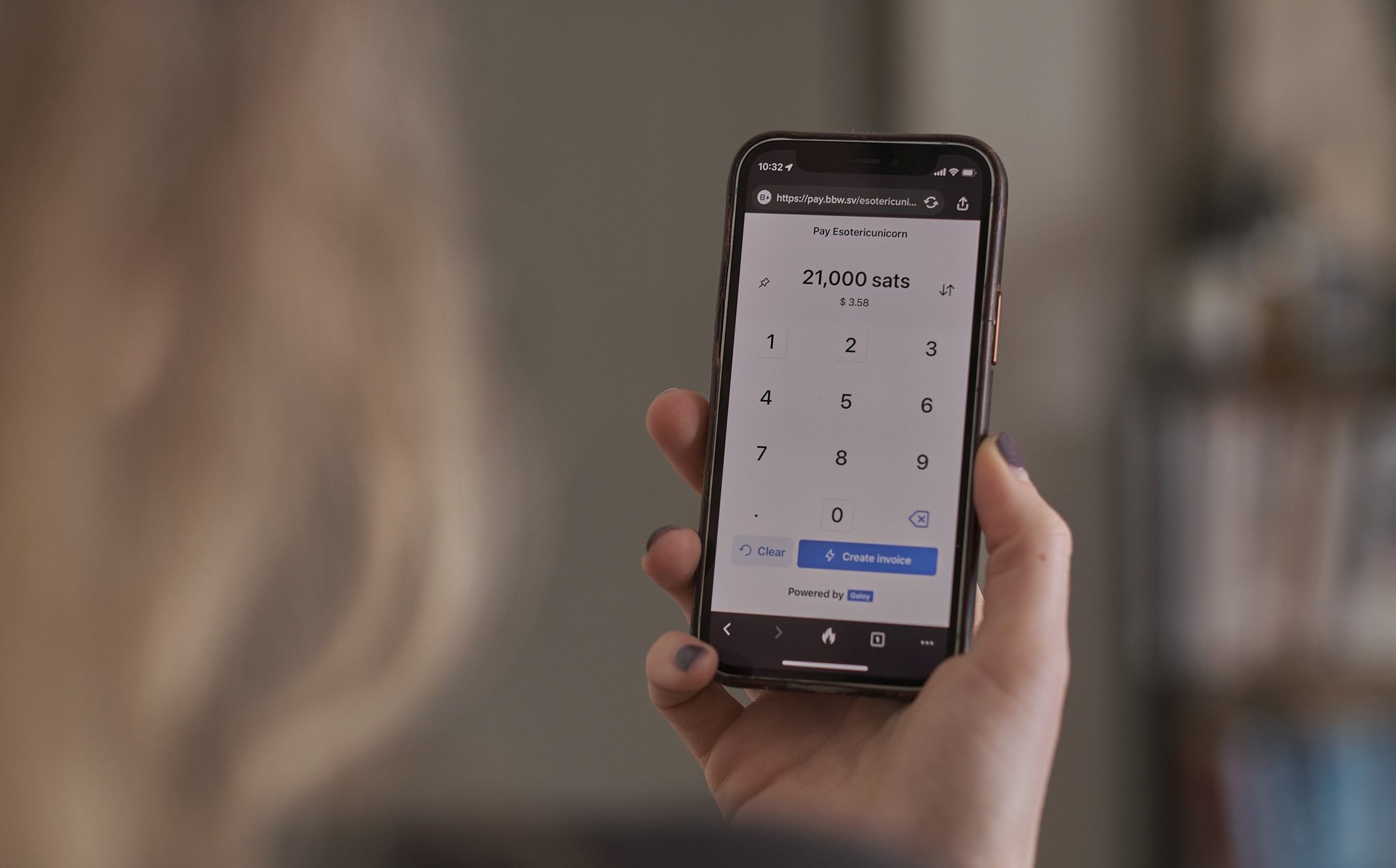

Due to its high efficiency, the Lightning Network can also be used for cross-border payments by companies and address frictions in cross-border payments. Today, we are seeing an ever-increasing interest from financial institutions to use Lightning to settle dollars or any other currency internationally with other financial institutions and service platforms around the world. Due to Bitcoin’s volatility, this involves exchanging the received payment directly into the local currency or hedging the risk via contracts. The Lightning enterprise software provider Galoy makes it possible to implement risk hedging on account of exchange rate fluctuations in an automated and cost-efficient manner. The process is explained in detail at stablesats.com.

Conclusion

Bitcoin in combination with the Lightning Network, has enormous disruptive potential for almost all industries. Payment streams form a fundamental part of all business models. As they change in cost, size, speed, reach, and participants, enterprises must adjust their strategies accordingly. Due to the diversity of industrial use cases, a first ecosystem of specialized consultancies has already developed to help companies take advantage of exploiting the potential of Bitcoin and in particular the Lightning Network.

In this article, we have shown that Lightning can be a promising solution for use cases such as machine-to-machine payments or cross-border payments. In the next article, we will discuss retail applications for the Bitcoin Lightning Network.

About the Authors

Daniel Wingen has studied blockchains and cryptocurrencies since 2015. He is working as Director of Business Development at Galoy Inc, an open-source enterprise software for Lightning. He is also the program director for the Industry Day of the largest German speaking Bitcoin conference and co-founder of the Bitcoin grassroots movement EINUNDZWANZIG.

Martin Betz is the Managing Director of Consulting Bitcoin. The consultancy specializes in creating company-specific strategy positions on the Bitcoin megatrend and the development of new Bitcoin-based business models. In addition to Bitcoin Effect, he is also co-founder of the German-language Nodesignal podcast.

Dr. Jonas Groß is Head of Digital Assets and Currencies at etonec GmbH. Jonas holds a PhD in Economics from the University of Bayreuth, and his main areas of interest are digital central bank currencies, stablecoins, cryptocurrencies and monetary policy. In addition, Jonas is chairman of the Digital Euro Association (DEA), co-host of the podcast “Bitcoin, Fiat, & Rock ‘n’ Roll”, and a member of the Expert Panel of the European Blockchain Observatory and Forum.